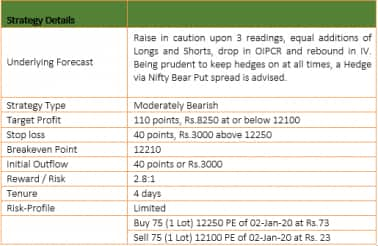

Support for Nifty at 12,200, hedge with Bear Put spread: Shubham Agarwal

Weekly congestion and monthly series equal congestion (both call and put) in Nifty signify support in 12,200 on the lower side, while there is no strong immediate hurdle on the higher side.

SHUBHAM AGARWAL | 06-Jan-20

Reading Time: 3 minutes

Every few months there comes a time when the indecisiveness kicks in. More often than not this is preceded by a big move in either direction. The best way in a situation like this is to avoid trading the market, but traders will be traders.

Plus now a days there are prolonged consolidations so avoiding to trade for a period of 2-3 months is not a very good idea.

As empirically observed by me (your opinion may differ), the bigger the preceding move longer would be the consolidation. Just to refer to one of the biggest moves in recent decades was the move from 6,000+ levels to 2,000+ levels in Nifty where the index lost almost 2/3rd of its value.

The following consolidation after the same that kicked in since 2009 kept the indices in range for over a year. So, every time we see an unprecedented rise or drop there is a possibility of such consolidation.

Once we see the digestion starting after a typical 10-12 percent (minimum) move, there would come a time when suddenly the trades in favour of the prevailing direction as well as against it the trades start losing.

In such a situation, hold the guns at once. Take a look around, in the data as more often than not one would find Options Open interest in Out of The Money (Higher Call/ Lower Put) strikes within around 5 percent range of current index almost equally divided.

Derivatives being reactive science, just an attempt or two in surpassing those levels creates a congestion and those heaviest Call-Put helps us in defining the range.

Once the range is defined first job is to put a short volatility trade in place. What has worked for me is to sell both Call & Put of a strike closest to CMP of the index. Being index, the volatility is not violent and liquidity is enough as well.

In practice though I have always and would recommend to always buy protection. Create long positions in OTM Options just outside the range or with the strikes of the range defined by Highest Open Interest Call & Put.

Remember the maximum profit would be net premium received and max loss would be difference between Buy strike and Sell Strike minus net premium received. It is always better to get this economics rightly set before entering the trade.

Apart from this two other modifications to the existing trading plan as far as individual stock option trades are concerned. One while within the range and other while on the edges.

While we are trading within the range, there generally is a directional impulse, just that it is short lived. That very fact makes the market oscillating. So, to adapt to this first modification is to reduce the time horizon of the trades.

While in absolute terms the index or the stocks may not be putting big gains or losses on the charts, there certainly is short-lived volatility. We have always tried and traded this only during the day, no matter how promising the trade is. Avoid over trading in intra-day but at the same time avoid too many carry forwards.

Lastly, when we are trading on the edges. Remember to have a mix of longs and shorts. This has worked despite of the fact that one of the trade is certainly going to be making a loss. The reason is, while the break out is expected to be fierce, the failures are also more often than not equally fierce in the opposite direction.

Thus, while in oscillation unlike the secular directional move, it is advisable to have constant level driven modifications in trades with respect to direction and longevity of trades.

Risk management at the bounds with mix of longs and shorts

Within the range time bound single options.

(The author is CEO & Head of Research at Quantsapp)

Disclaimer: The views and investment tips expressed by investment experts on moneycontrol.com are their own, and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Learn and read more about futures from Quantsapp classroom which has been curated for understanding of sgx nifty future from scratch, to enable option traders grasp the concepts practically and apply them in a data-driven trading approach.

Recent Articles

How to trade after a big trading day, explains Shubham Agarwal

07-Feb-26

Smart portfolio hedging in market downturns: Shubham Agarwal

31-Jan-26

How to trade when markets go wild: Shubham Agarwal

24-Jan-26

Option writing before the Budget: Why calendars beat naked shorts

17-Jan-26

How smart money trades before the Budget: Shubham Agarwal

10-Jan-26

Change yourself, change your result, says market trader Shubham Agarwal

06-Jan-26

Knowing when not to adjust trades: Shubham Agarwal

27-Dec-25

How to make profit when markets go sideways: Shubham Agarwal

20-Dec-25

SHUBHAM AGARWAL is a CEO & Head of Research at Quantsapp Pvt. Ltd. He has been into many major kinds of market research and has been a programmer himself in Tens of programming languages. Earlier to the current position, Shubham has served for Motilal Oswal as Head of Quantitative, Technical & Derivatives Research and as a Technical Analyst at JM Financial.

Recent Articles

How to trade after a big trading day, explains Shubham Agarwal

07-Feb-26 08:34:00

Smart portfolio hedging in market downturns: Shubham Agarwal

31-Jan-26 09:50:00

How to trade when markets go wild: Shubham Agarwal

24-Jan-26 09:10:00

Option writing before the Budget: Why calendars beat naked shorts

17-Jan-26 08:20:00

How smart money trades before the Budget: Shubham Agarwal

10-Jan-26 08:14:00

Change yourself, change your result, says market trader Shubham Agarwal

06-Jan-26 14:58:00

Knowing when not to adjust trades: Shubham Agarwal

27-Dec-25 10:58:00