Hedge Nifty positions by deploying Bear Put Spread: Shubham Agarwal

The weak sentiment indicated for this week, along with possibility of ongoing consolidation to continue is advised to be traded with Bear Put Spread.

SHUBHAM AGARWAL | 02-Jun-20

Reading Time: 3 minutes

After a weak start to the week with over 3 percent cut in the first session itself Nifty recovered fairly well in fowling two sessions, however softer rest of the week humbled the recovery. Despite of stellar recovery attempt from the lows, Nifty ended the week with a loss of over a percent for the week.

Bank Nifty on the other hand, took it in the chin. This was evident in the fact that the bank major ended this week at the lower level of closing. The drop in the first session for Bank Nifty was more lethal than Nifty with a 6 percent cut. Minor recoveries and bigger drag in the last session pushed Bank Nifty lower by over 8 percent for the week.

Nifty futures added majority of shorts in the beginning of the week itself. The two-session recovery marked increment of minor long interest, while the last two session had unwinding of longs and addition of further short interest. Nifty ended the week with 13 percent addition of short interest.

Bank Nifty on the other hand, did not have any such confusion, its futures were marked either incremental short interest or unwinding of one. This resulted in increment of almost 50 percent short interest for the week in Bank Nifty.

Stock futures were no different in adding pessimism this week. The aggregate stock futures open interest went up by over 10 percent for the week. This was a sizable increment.

The composition for the stock futures too for this week remained tilted towards shorts. Despite the upcoming week being expiry, the unwinding remained fairly low. On the sentimental front, mixed signals were received more so due to technical reasons.

Slicing the stock futures data further, two thig peculiar to this week’s futures Open Interest (OI) activity was that the sector wise OI activity was more or less secular in many and defensives like FMCG and Pharma made a comeback. Secular longs were seen in Pharma, IT and FMCG. Similarly, sector wide shorts were seen in NBFC, PSU Banks and Pvt. Banks.

Among Nifty options, 9000 Put is the highlight of the upcoming weekly cum monthly expiry. Two more notables are higher number of call interest addition over the week and the deep out of the money put open interest in strikes below 8000, which has kept the OIPCR upbeat.

Sentimentally, the recovery not getting bought into substantially could have pushed India VIX higher for the weekend but the long weekend led adjustment in time value had its effect on Option Premiums keeping the risk index understated. Sustaining these levels amid expected volatility led by expiry week could be challenging, hence proper hedges must be resorted to.

Finally, Shorts in Nifty futures and massive shorts in Bank Nifty makes the up move from recent lows vulnerable for a pull back. Heavy OI in 9000 Put looks too overconfident, which in case of a breach could trigger many long stop losses raiding the intensity of the pull back.

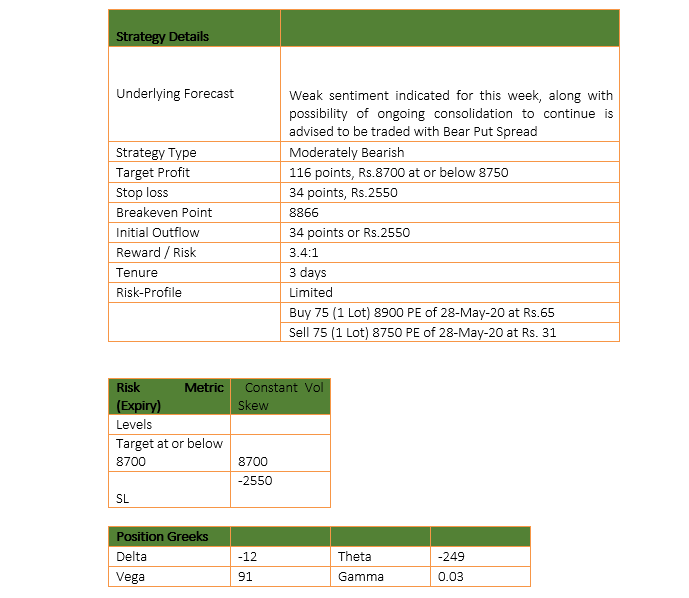

On the other hand, possibility of 9000 being held and continuation of the ongoing consolidation cannot be ruled out either. Hence, weak sentiment is indicated for this week, along with possibility of ongoing consolidation continuing. Advise to trade with Bear Put Spread.

Bear Put spread is a moderately bearish strategy. The strategy is built by Buying a Put close to the current market price of the underlying and Selling same expiry Put but of a strike lower than the Put bought.

The sold Put strike would be limit the profit but fund the put buying. Profits are limited to difference between strikes minus the net premium paid.

https://images.moneycontrol.com/static-mcnews/2020/05/SA-1.png

https://images.moneycontrol.com/static-mcnews/2020/05/SA1.png

(The author is CEO & Head of Research at Quantsapp Private Limited.)

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Learn and read more about NSE India from Quantsapp classroom which has been curated for understanding of open interest from scratch, to enable option traders grasp the concepts practically and apply them in a data-driven trading approach.

Recent Articles

The right way to trade options in expiry week: Shubham Agarwal

21-Feb-26

Monetising Your Portfolio: A practical guide to covered calls

14-Feb-26

How to trade after a big trading day, explains Shubham Agarwal

07-Feb-26

Smart portfolio hedging in market downturns: Shubham Agarwal

31-Jan-26

How to trade when markets go wild: Shubham Agarwal

24-Jan-26

Option writing before the Budget: Why calendars beat naked shorts

17-Jan-26

How smart money trades before the Budget: Shubham Agarwal

10-Jan-26

Change yourself, change your result, says market trader Shubham Agarwal

06-Jan-26

SHUBHAM AGARWAL is a CEO & Head of Research at Quantsapp Pvt. Ltd. He has been into many major kinds of market research and has been a programmer himself in Tens of programming languages. Earlier to the current position, Shubham has served for Motilal Oswal as Head of Quantitative, Technical & Derivatives Research and as a Technical Analyst at JM Financial.

Recent Articles

The right way to trade options in expiry week: Shubham Agarwal

21-Feb-26 08:35:00

Monetising Your Portfolio: A practical guide to covered calls

14-Feb-26 10:23:00

How to trade after a big trading day, explains Shubham Agarwal

07-Feb-26 08:34:00

Smart portfolio hedging in market downturns: Shubham Agarwal

31-Jan-26 09:50:00

How to trade when markets go wild: Shubham Agarwal

24-Jan-26 09:10:00

Option writing before the Budget: Why calendars beat naked shorts

17-Jan-26 08:20:00

How smart money trades before the Budget: Shubham Agarwal

10-Jan-26 08:14:00