Deploy Modified Call Butterfly strategy in Nifty: Shubham Agarwal

With Nifty close to its highest level of recent weeks, OIPCR still has room to rise which is comforting.The overall composition at least for Nifty does favor the bulls.

SHUBHAM AGARWAL | 13-Jul-20

Reading Time: 3 minutes

The market witnessed another week of gains last week. It opened with a gap up and managed to sustain it throughout the week. However, the incremental gains were limited as Nifty consolidated in a narrow range to end the week 1.5 percent higher.

Action, on the other hand, could be seen in Bank Nifty where the moves were more emphatic and the gains were proportionally higher in the subsequent days after a rather muted start to the week. The high made mid-week though could never be pierced in the last two sessions. The 2%+ blow in the last session on top of that led Bank Nifty to end the week relatively deeper than Nifty. Nonetheless, the final gains were bigger than that of Nifty at 2.5 percent.

Open Interest also had similar stories to tell as far both the indices are concerned. Nifty after opening higher attracted few longs. The good part about Nifty’s Open Interest (OI) activity was the sequence of long and long winding alongside the ups and downs of the week.

Bank Nifty had a bit of a blow mid-week when it ended the session way off the top. This resulted in the addition of short interest. That day along with last session shorts created a confusing mix of long and shorts in Bank Nifty OI addition of almost 20 percent. This question the directional bias of the weekly gain.

On the stock futures front, the divide was equally visible. Despite the rising regime in the market and upbeat mood in Nifty, the OI activity saw a mix of longs and shorts. The stocks adding shorts were, in fact, higher than the number of stocks adding longs. One of the reasons for this could be 25 percent of stocks covering shorts. Long awaiting pessimism amid the pandemic was seen exiting this week in many stocks.

Dicing the stock futures OI sector wise, the biggest notable this week was the mix contribution of Long and Short even within the sector. Largest OI addition was in PSU Banks but with Longs in SBI and Shorts or withdrawal in rest of the stocks. Similarly, Reliance added longs in Oil while OMCs added shorts. Power added shorts, even FMCG had mixed built up with notable longs in Tata Consumer and McDOWELL-N.

Coming down to sentiments, the risk index India VIX kept up its comforting ride. This week too there was a drop of a percent, which could be largely due to Nifty sustaining the gains. On one hand, where it is comforting to have this reading, considering the mean reversion characteristic of the index, there is always a threat to revert higher.

On the options front, we did not have any such extremism as the OIPCR remains in a rather moderate zone. With Nifty close to its highest level of recent weeks, OIPCR still has room to rise which is comforting. The overall composition at least for Nifty does favour the bulls.

Finally, Longs in futures this week in Nifty augurs well for the momentum to continue. Even the options composition remains in favour of Bulls with moderately bullish OIPCR. Nifty Options IV remain positive as well but being in the lower extreme is a bit risky. The flow of longs in Nifty futures along with comfort from sentimental indicators amid mixed bias from stock futures could be traded with prudence via Modified Call Butterfly.

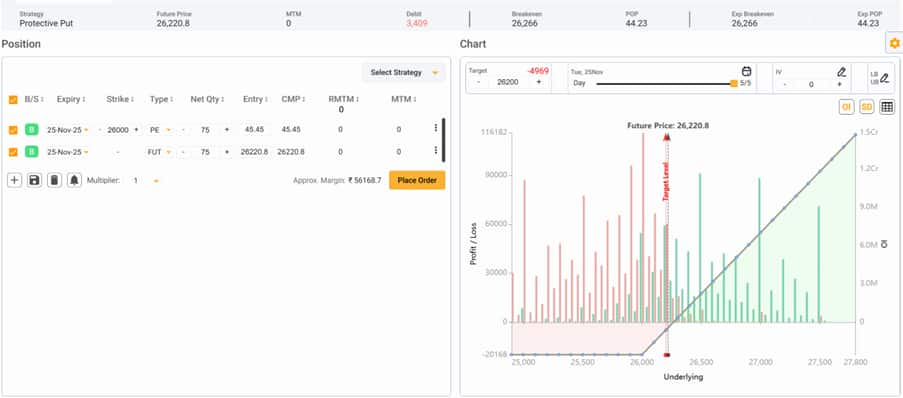

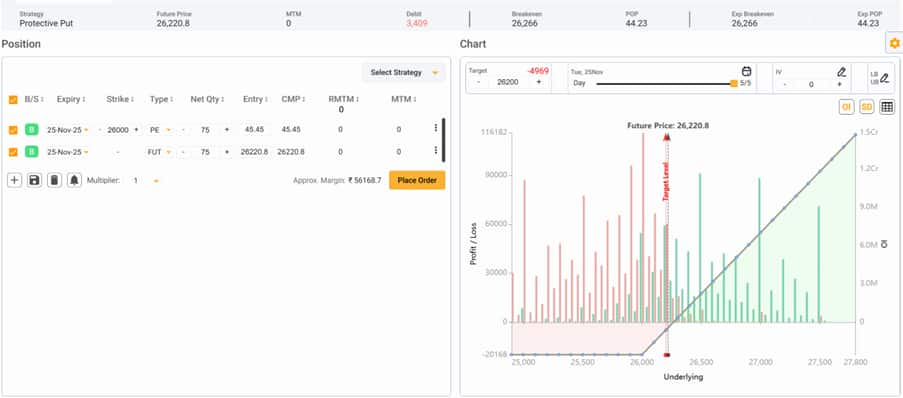

Modified Call Butterfly is a 4-legged strategy where 1 lot of Call close to current underlying level is bought against that 2 lots of higher strike calls are sold and 1 more lot of Call is bought but closer to the call sold strike. This keeps the lower but constant profits in case of an upward breakout. This is a fairly risk averse and a universal strategy.

The author is CEO & Head of Research at Quantsapp.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Learn and read more about options trading from Quantsapp classroom which has been curated for understanding of options trading strategies from scratch, to enable option traders grasp the concepts practically and apply them in a data-driven trading approach.

Recent Articles

How to make profit when markets go sideways: Shubham Agarwal

20-Dec-25

Beyond Panic: Take control when your derivatives trade turns red, says Shubham Agarwal!

13-Dec-25

Evolve Your Trade: The missing step in most trading systems: Shubham Agarwal

06-Dec-25

Best trending option trading strategies: Shubham Agarwal

29-Nov-25

3 best ways to hedge using Options: Shubham Agarwal!

22-Nov-25

When in doubt to write, do Iron Fly: Shubham Agarwal!

15-Nov-25

Identify potential turning points with advance-decline: Shubham Agarwal

08-Nov-25

Slow and spreads more efficient: Shubham Agarwal

01-Nov-25

SHUBHAM AGARWAL is a CEO & Head of Research at Quantsapp Pvt. Ltd. He has been into many major kinds of market research and has been a programmer himself in Tens of programming languages. Earlier to the current position, Shubham has served for Motilal Oswal as Head of Quantitative, Technical & Derivatives Research and as a Technical Analyst at JM Financial.

Recent Articles

How to make profit when markets go sideways: Shubham Agarwal

20-Dec-25 12:14:00

Beyond Panic: Take control when your derivatives trade turns red, says Shubham Agarwal!

13-Dec-25 09:12:00

Evolve Your Trade: The missing step in most trading systems: Shubham Agarwal

06-Dec-25 20:43:00

Best trending option trading strategies: Shubham Agarwal

29-Nov-25 09:32:00

3 best ways to hedge using Options: Shubham Agarwal!

22-Nov-25 09:11:00

When in doubt to write, do Iron Fly: Shubham Agarwal!

15-Nov-25 10:48:00

Identify potential turning points with advance-decline: Shubham Agarwal

08-Nov-25 10:35:00